Frequently Asked Questions:

What forms of payment does the Municipality of Elton accept?

For all details for regarding summitting payments to the RM of Elton please click - Rural Municipality of Elton - Payments

When are utility charges invoiced?

Utility billing are quarterly. March, June, September & December of each year.

When are Property Tax Notices sent out? And when are they due?

Elton tries to get property tax notices sent out in Early August of every year. Property tax payments are due on the last business day in October of every year.

Homeowners Affordability Tax Credit (Formerly the Education Property Tax Credit)

For more information regarding the Homeowners Affordability Tax Credit please visit the Province of Manitoba website at Province of Manitoba | finance - Education Property Tax Credit. You can access and print the required Self Declaration Form by following the link, HATC Self Declaration Form or you may visit the Municipal Office at 107129 Road 65N, Forrest, Manitoba, to obtain a physical copy.

Am I eligible for the Farmland School Tax Rebate?

The Farmland School Tax Rebate applies to all Class 30 Assessments of farm land only. Forms will be mailed out to you from your local Manitoba Agricultural Services Corporation (MASC). If you did not receive a form please contact your local MASC office.

Is there a place I can search for more details about a property?

In accordance with the Freedom of Information and Protection of Privacy Act, no personal identifiers are included in the Government of Manitoba property assessment search database. You are able to search for property assessment information (using the legal description, roll number, or street address) by clicking on the link below.

https://www.gov.mb.ca/mao/public/search_select.aspx

How is assessment value determined?

Generally, assessment value is determined by comparing your home to others that have recently sold in the same area of your Municipality, provided they are roughly the same vintage, condition, and size.

Where can I retrieve more information on my current property tax assessment?

The local assessment office is located in Brandon, MB. You can contact them at 204-726-6001 or assessmentbrandon@gov.mb.ca.

Who may attend Council Meetings?

Council meetings are open to the public, however if you would like to appear as a delegation, please contact the Municipal Office.

Delegations:

- The Chair may limit the time taken by a delegation to ten (10) minutes. The delegation must appoint a spokesperson.

- To allow members of Council to prepare for delegations, all presenters shall register with the CAO at least seven (7) days before the Council meeting or at the discretion of the CAO and advise the CAO of the topic and scope of the presentation. All materials presented must be forwarded to the CAO five (5) days prior to the meeting.

- There shall not be a limit to the number of delegations included on the agenda of a Council meeting, but the CAO is granted authority to schedule delegations as deemed appropriate.

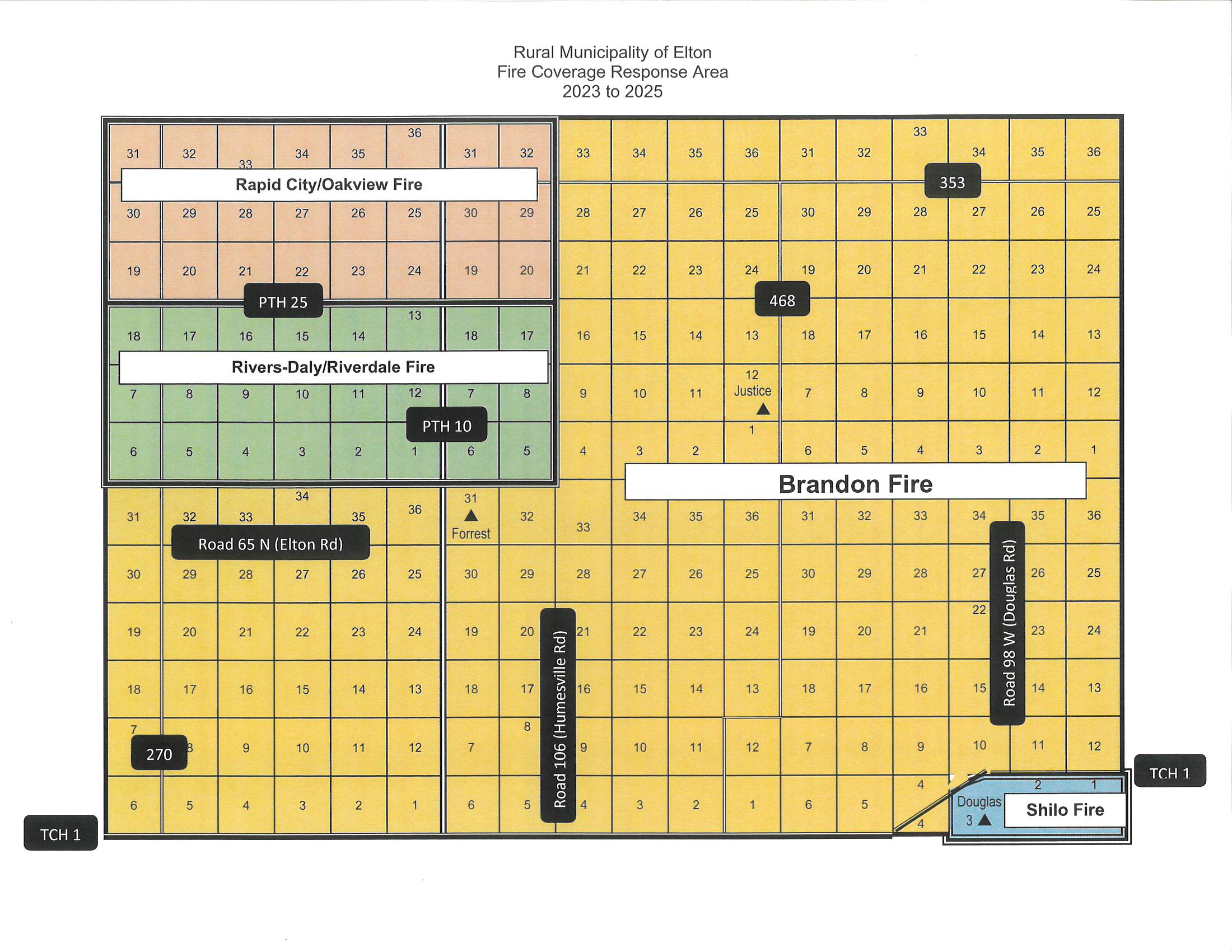

Where can I obtain a map of the RM of Elton? And what are the costs?

Elton maps are available for purchase at the Municipal Office for a cost of $20.00 each. Maps are updated each time they are ordered. We only order new maps when we are starting to run out of the current maps. If you wish to have your name removed from the property ownership map, please contact the Municipal Office.

What are the costs for a Tax Certificate?

The current cost of a Municipality issued Tax Certificate is $40.00 per roll number.